Background and Sale of Company Assets by the Director

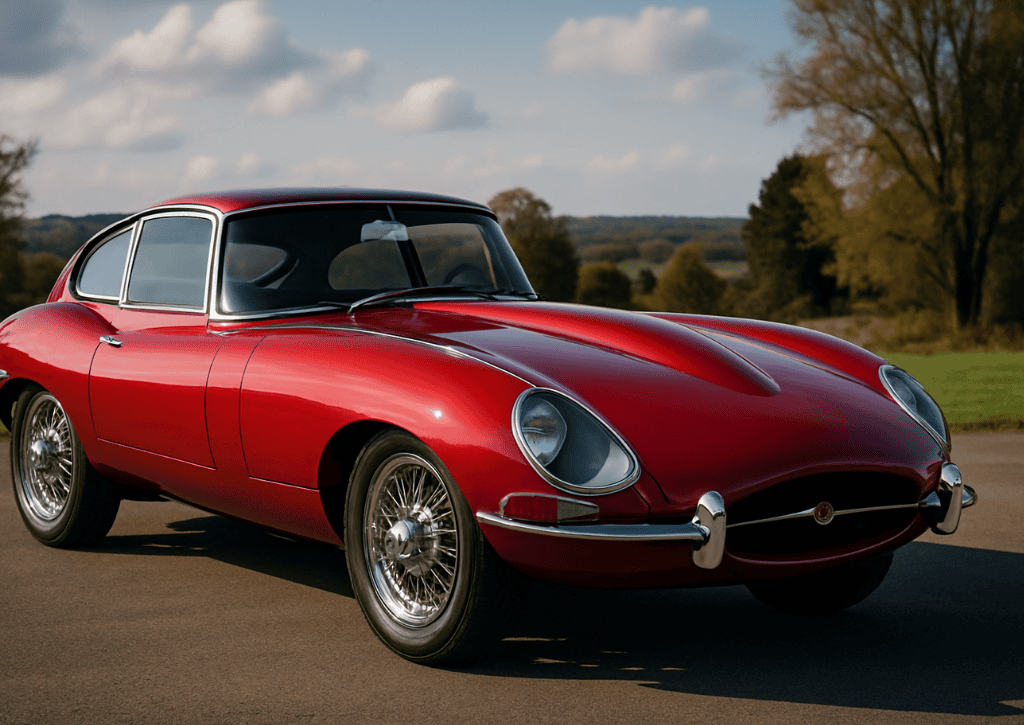

A director has been disqualified for six years by the Secretary of State for the Department of Business, Energy, and Industrial Strategy (‘SOS’). The director was found to have sold seven classic cars to a connected company (which he also controlled) for a nominal fee of £1.00, when the actual market value of the seven classic cars totalled £101,500.00.

This transaction had severe consequences for the original business. The first was the loss of the seven highly valuable classic cars, and the second was the failure to receive the full market value payment of £101,500.00. The evident Transaction at Undervalue and the general conduct of the director led to the SOS’s investigation, highlighting the serious implications of such actions.

Transactions at Undervalue (‘TUV’)

TUVs are legislated by Section 238 of the Insolvency Act 1986 for companies and Section 339 of the Insolvency Act 1986 for individuals. A claim or allegation pursuant to a TUV may arise when a company or person enters into a transaction and transfers an asset for less than its full market value, usually at a time when that company or person is financially stretched and/or immediately before becoming insolvent.

Applied to the facts, the following can quickly be established:

- The Company owned highly valuable classic cars worth £101,500.00.

- The Company (by the conduct of the director) approved the transfer of the cars to a connected for the sum of £1.00. Therefore, it can be quickly established that this was a TUV, with the classic cars being sold for little to no consideration and significantly less than their actual market value.

Why does TUV legislation exist, and what is its purpose?

The TUV legislation (Sections 238 and 339 of the Insolvency Act 1986) is designed to protect creditors. It aims to prevent individuals from giving away or selling assets at a price below their actual market value before going bankrupt or a company being placed into liquidation, in an attempt to put assets beyond the reach of its creditors.

If a TUV has been established, the SOS will usually only pursue disqualification against the director and leave the Trustee in Bankruptcy or the Liquidator to pursue any relevant legal action regarding the transaction itself. Please see below.

Can assets that have already been sold be recovered, and who brings the claim?

In the event a Trustee in Bankruptcy or a Liquidator identifies a TUV, the transaction can then be challenged and reversed. However, this process can be time-consuming and very expensive. Therefore, the Trustee in Bankruptcy or the Liquidator will usually attempt to resolve the dispute with the individual, director and the recipient who has received the benefit of the transaction first before intimating any court action.

If no resolution can be agreed upon, the Trustee in Bankruptcy or the Liquidator will then have to issue court proceedings to reverse the transaction or obtain a court order requiring the director to pay the actual market value of the assets.

When must a claim be brought?

To challenge a TUV given to a connected person (for example, a company controlled by the same mutual director, partner, family member or friend) or company, the following must be satisfied:

- The transaction occurred within two years prior to the onset of insolvency.

- The company at the time of entering into the transaction was unable to pay its debts.

- The company becomes insolvent as a result of entering into the transaction.

Some transactions are excluded and can be more difficult to establish as TUVs. For example, transactions entered into by directors in good faith, honestly and for genuine business reasons. However, each case is determined and reviewed on its individual merits.

What is the potential exposure for directors?

In the event a TUV has been established, the ramifications for a director can be severe, potentially leading to disqualification for a period of up to 15 years. This can include:

- Being disqualified for a period of up to 15 years. The director in this case has been disqualified for 6 years. Considering the facts, the period appears to be relatively low. However, each case is determined on a case-by-case basis. Cases containing allegations of TUV typically result in disqualification ranging from 9 to 12 years.

- Potentially facing legal action by the Liquidator for the transaction to either be reversed or the director to pay the actual market value of the assets transferred. This could amount to many thousands of pounds if proceedings are issued, and depending on the exact value of the assets. If proceedings are issued, the Liquidator would also seek to recover his legal costs in addition to the sum sought from the director, plus interest.

- The reputational damage can also be hugely destructive to a director’s ability to trade moving forward. This particular case has been reported via the BBC News Network, a major news reporting organisation whose influence is far-reaching. Therefore, even if a resolution is quickly agreed upon with the Liquidator, the director will most likely have incurred significant reputational damage by going through this process.

Voluntary Disqualification Undertaking (‘VDU’)

You will note that in this particular case, the director decided to provide a VDU to the SOS and not proceed to trial. However, what is a VDU, and how does it work?

- A VDU is a mechanism created by the SOS to enable a director to agree to be disqualified without having to proceed to trial, which can be very expensive and stressful for all parties.

- A VDU is usually a short document consisting of two to three pages, enabling the director to sign the VDU, agreeing to be disqualified for the period stated within it.

- A VDU provides a mechanism for all parties to bring the matter to a swift resolution, without recourse to the court, with the VDU holding the exact equivalency as a court-ordered disqualification order against the director.

A closer examination of what, how, and whether a director should sign a VDU is crucial for understanding the process and making an informed decision. This can be explored on our website and in the article dealing with VDUs, which is available separately.

Change in approach by the SOS in relation to asset stripping

We have noted in our recent dealings with both the Insolvency Service (‘the IS’) (the investigative arm of the SOS, which typically carries out enquiries before referring the matter to the SOS) and the SOS, that a much stricter approach is being taken concerning the investigation of transactions involving company assets. Following the COVID-19 pandemic (‘C19’), the SOS is acutely aware of more directors entering (whether deliberately or otherwise) into business transactions involving company assets without seeking either legal or professional accounting advice beforehand.

Under the SOS’s strict duty to preserve public confidence in the business sector, the SOS are now less willing to overlook and/or take a more relaxed approach when a director has deliberately or recklessly entered into a TUV, as shown in this case. The SOS is now attempting to hold to account, limit, and eventually eradicate a director’s ability to strip assets from a company without facing serious consequences for doing so.

Practical tips for directors to avoid claims for TUV

As outlined above, each case is investigated and reviewed on its individual merits, with no two cases being the same. However, to avoid and/or defend any TUV allegations brought by either the SOS or a Liquidator, a director could look to carry out the following steps:

- Record any discussions, decision-making or conclusions reached in respect of any transactions involving the transfer of company assets in writing. Meeting notes and Board Resolutions are preferred, but if not available, emails, signed contracts, agreements, or letters are also helpful. Setting out and recording in writing the thought process and justification for the price, as well as the reason for the transfer, can go a long way in justifying the transaction at a later stage, if required.

- Seek and obtain independent valuations of any company assets that you are seeking to sell. Independent valuations assist in corroborating the market price at which the asset was sold, are independent, and demonstrate that you, as a director, have gone through a methodical process in obtaining valuations, setting a price for the assets, and then selling those assets for that price.

- Before proceeding with any transaction, seek professional advice from the company accountant or independent legal advice and record that advice in writing.

The above is not an exhaustive list, but it provides a director with a flavour of the information and/or documentation that they should seek to obtain to protect themselves from criticism and potentially a substantial claim later on.

Summary and final thoughts

It is often the case that business matters and trade are attended to. Still, administrative issues are usually left to be dealt with on another day, or in some instances, never. As set out above, this can lead to grave consequences, resulting in a director being disqualified for an extended period and, worst still, facing a substantial financial claim from a Liquidator.

We at D & N Solicitors have dealt with various cases where a director has acted truthfully, faithfully and transparently in relation to the discharge of his duties owed to the company. However, due to not taking crucial steps as identified above (seeking financial, accounting, and legal advice, not recording anything in writing, and not obtaining independent valuations), this has resulted in the director being banned and facing significant financial penalties as well.

It is therefore essential to seek early engagement with solicitors to avoid a similar fate to the director reviewed in this case study.

If you have any questions arising from this case study, please do not hesitate to contact us. We at D & N Solicitors regularly deal with all disqualification matters. We are readily available to provide specialist director disqualification advice, information and tactics on how to potentially avoid bans.